How to Clear the 12 “Serious Money” Hurdles

by Leon J. Owens

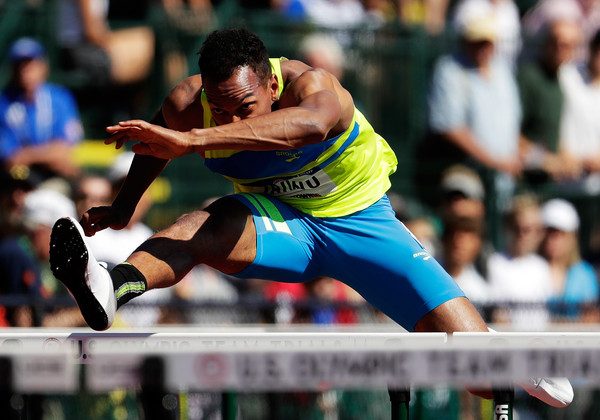

Running After Money?

When the owners and managers of thriving businesses—who are already running as fast as they can—find themselves chasing an infusion of significant capital, investors and lenders point to some frequently daunting stumbling blocks beyond the obvious. Current sales and revenue numbers can be impressive, but they don’t always tell the complete story.

Whether you need funding for anticipated inventory needs, capital equipment, additional outlets or expanded operating facilities, it all comes down to your company’s genuine risk profile. Lenders want to be certain you’ll be able to repay any principal loan amount with interest. Investors want to be sure you’ll stay in business and generate enough growth to throw off promised profits.

If you’re able to provide that certainty and deliver on those promises, you’ll have to prove it by jumping these 12 immoveable hurdles:

- Be ready to provide complete and candid backgrounds of Founders and the Management Team

- Always have an up-to-date business plan in hand

- Have three years’ financials and interim financial statements to show

- Provide current and projected balance sheets

- Compile and validate ongoing vendor and customer contracts

- Disclose past and current liabilities: accounts payable, negative business issues, liens, judgments, claims, tax issues, bad debts, delivery challenges, pending or anticipated litigation, outstanding personal guarantees

- Be prepared to pay off any existing liens or get them “subordinated” to the “fresh money.”

- Know your Accounts Receivables and aging details

- Be ready for visits to work areas, know individual and team roles

- Disclose all current lending relationships or prior guarantees

- Reveal all ownership issues: stockholders, venture capital obligations

- Prepare a complete review of your insurance coverage and past tax returns, both corporate and personal

Regardless of how high you clear those hurdles, banks will obviously look at your ability to repay any loan, and they’ll expect you to back that up with collateralized receivables or hard assets. If you offer current inventory as collateral, expect them to assess it carefully and to discount its value. Any prospective lender will very likely require a personal guarantee that will take priority over any existing guarantees, so you should be prepared to pay those off before you see any “fresh money” arriving at your doorstep.

Running a business in today’s competitive environment requires strength, agility, timing, and stamina. When you’re going after “serious money” keep the finish line in sight and be persistent. Businesses success is not won in a sprint, but over the long term.